tl;dr

- L3s have been proposed as a fix for crypto scaling, but they come with many downsides

- Aggregated L2s have all the benefits, but not the downsides, with true scale for crypto

- Some L3s may experience interoperability within a single L2 ecosystem, but this still fragments liquidity and users by creating moats

- Fee extraction is baked into many L3 models, which rely on L2 for settlement

- L3s sacrifice some sovereignty, relying on governance and fee extraction as imposed by the L2s

Developers have never had more choices than they have now. How to build, where to build, what to build: There are tons of options for crypto devs to embrace sovereignty across any number of technologies.

But true sovereignty depends on a tech stack that encodes that idea.

When Layer 3 blockchains (L3s) are proposed as a solution in the crypto scaling debate, it is often with false dichotomies. Proponents claim L3s have a number of benefits over Layer 2s (L2s) that should permanently put them on the crypto scaling roadmap.

Polygon Labs doesn’t think this is a good idea. In fact, along with other major thinkers in the space, we worry that L3s are dressed up as architectural necessities when in fact they risk locking in ecosystem-specific network effects for whatever L2 by creating demand for that network’s blockspace at the expense of sovereignty, the will of an L2s governance, inefficient bridging, and the broader health of Ethereum.

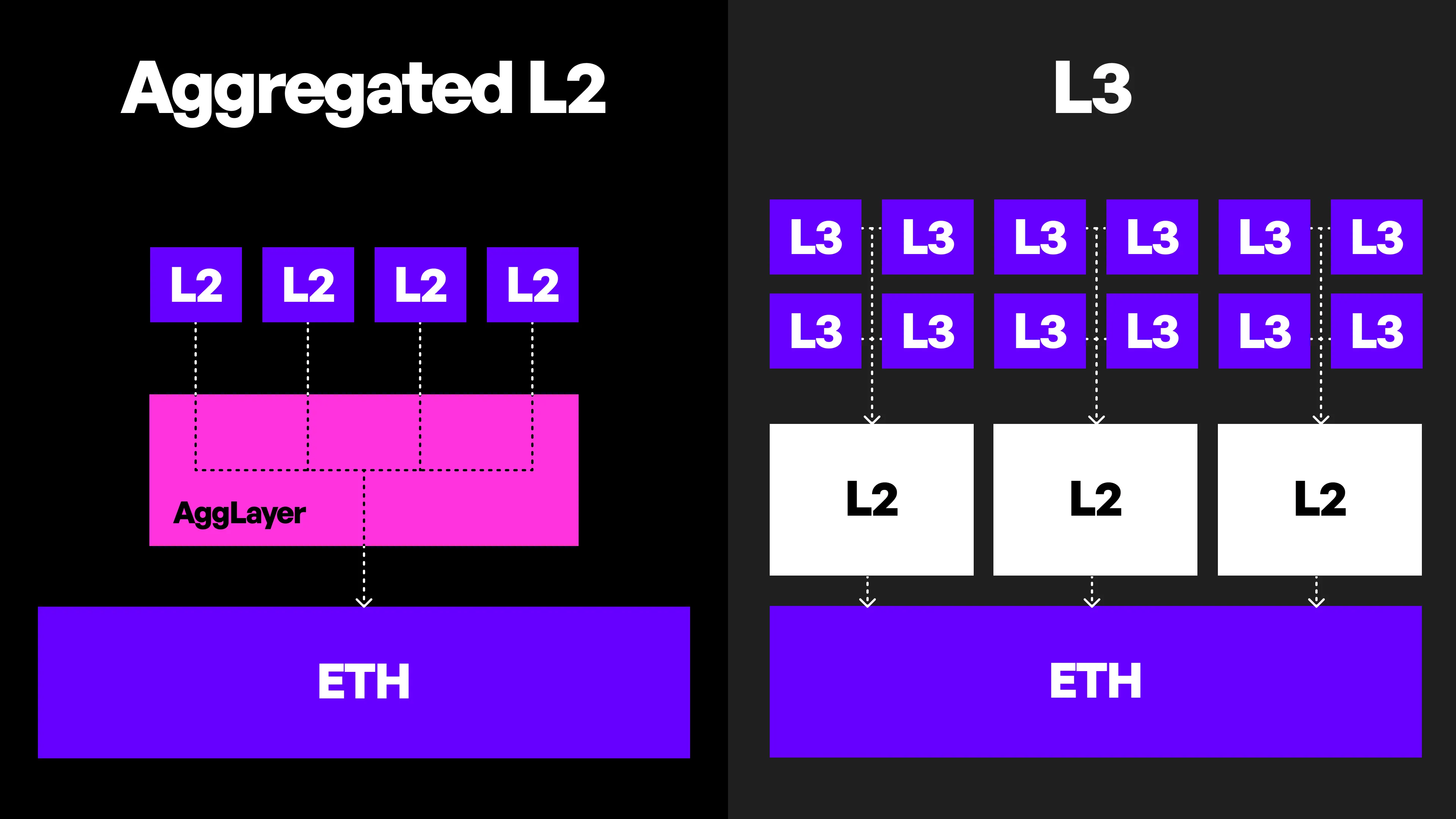

Far from fixing fragmentation or encouraging horizontal growth, L3s create clusters of state and liquidity native to specific L2 ecosystems—exactly reproducing the current challenges of fragmentation in crypto scaling, rather than fixing them.

In fact, there are compelling arguments for why this is strictly good for specific L2s (not the L3s built on them), but probably not good for Ethereum. Far from driving network effects to Ethereum and encouraging unified liquidity and state, L3s turn respective L2s into the settlement layer. Value accrues to L2, but isn’t passed onto Ethereum.

This post will break apart the myths of L3s by showing how aggregated L2s are a positive sum game.

Strictly speaking, with the AggLayer, L1s, L2s, L3s, and L(N)s can interoperate in a multichain universe, with amortized fees and low latency, leveraging Ethereum as a settlement layer.

An aggregated, horizontally scalable network creates the conditions for shared liquidity and state, unifying rather than continuing to fracture crypto computation.

All this while also allowing developers and users to maintain sovereignty and avoid fee extraction.

This post breaks down the supposed benefits of L3s, and shows these are achievable when chains connect to the AggLayer.

Mythbusting L3 benefits

Plenty has been written and spoken about the supposed benefits of building and deploying an L3. Usually, these arguments are made by core developers of L2 projects, who have entrenched reasons to advocate for L3s.

We’ll walk through some major myths and break them apart. It turns out that the AggLayer, as a neutral public good for aggregated blockchain networks, endows the very same benefits (minus the drawbacks) for connected chains as those claimed to be unique for L3s.

Myth: L3s are customizable to a degree that’s not possible with L2s

Reality: L2s are customizable in any way a builder wants. L3s are proposed as a solution for endless customization, but the reality is that locking into an L2 ecosystem curtails sovereignty and therefore ultimate customization. L3s are subject to the L2s on which they’re built, while L2s can be customized without those risks.

And while chain development tools like OP Stack or Arbitrum Orbit offer appchains customization, there are also imposed requirements on sovereignty—different predefined governance frameworks or lock-ins to consensus mechanisms—or fee extraction.

Polygon CDK, on the other hand, allows for maximum choice and customization, without external demands or lock in.

That’s sovereignty.

Developers interested in building L3s can use Polygon CDK instead to spin up ZK-powered chains on-demand. Build custom chains with added mods and variations, from gas tokens to regulatory design concerns to sequencer type to data availability—and much more—all without extractive fees.

In fact, to build with Polygon CDK is to experience more customizability than the vision for L3s. Polygon CDK chains—or, really, any chain—can opt for fast interoperability and connect to the AggLayer, which means access to shared state and liquidity. As more chains connect to the AggLayer, all other chains benefit from shared liquidity and users.

Myth: L3s are the best way to amortize transaction costs because data is posted to an L2 and not to Ethereum

Reality: L2s can amortize costs through proof aggregation. L3s are posited as a way to amortize the cost of transactions because the expense of posting to Ethereum is replaced instead by posting to some arbitrary L2, which then will ferry transaction data to Ethereum. The idea is that if the L2 is the base layer, then transaction fees on L3 will be that much lower.

In reality, this architecture means chains must sacrifice sovereignty, possibly pay extractive fees, and concentrate power in one L2 ecosystem.

With zero-knowledge (ZK) proofs, an aggregated network can take a bunch of chain states, bundle them into a single proof, and post that to Ethereum. The unique trait that makes this possible is called recursion—which means one proof can be generated that is composed of many other proofs. A bunch of proofs are bundled together and unified into one—amortizing the cost not just of transactions, but (potentially) thousands of chain states.

This is, in fact, a benefit native only to ZK tech.

It might be the case that in an optimistic framework, L3s really do amortize transaction cost. But that’s because there’s no way to recursively aggregate fraud proofs—let alone recursively aggregate chain states. The L2 becomes the aggregate of chain states.

With the AggLayer, ZK tech significantly reduces the cost of posting to L1 by using recursion to amortize the fee across what can be thousands of chains—and without imposing on sovereignty.

All of the above is part of a larger myth: That an optimistic framework will somehow always be cheaper than ZK architecture. Not only is this untrue, but it will be increasingly less true as the technology improves and more chains connect to the AggLayer.

Myth: L3s are better for multichain interoperability

Reality: L2s are better for multichain interop. The L2/L3 model comes with a number of security and economic considerations that make it strictly worse for multichain interop. The L2 operators on which an L3 is settled may control translation order, inclusion on L2, and when L3s are settled on blocks. Even with decentralized sequencers, sequencers will behave in an economically rational way, which may mean censoring L3 settlement in order to extract MEV on L2, charging rent, and so on.

In other words, interop gained but at the cost of extracting value from users and developers of an L3 chain by the L2 on which it is settled.

An aggregated framework is superior for multichain interoperability, and the reason comes down to two important elements: sovereignty and maximum extractable value (MEV).

An aggregated network provides a secure, low-latency way for any chain, whether L1 or L(n), to send transactions across one or many chains. Crucially, the AggLayer is not involved with ordering or including transactions at all—only the pre-sequenced blocks from chains.

So the incentives are different on the AggLayer. There are no assets natively on the AggLayer, nothing to be gained by changing ordering, and a material difference for AggLayer validators compared to sequencers operating on an L2 with an L3 ecosystem.

The case is harder to figure out how AggLayer validators would extract MEV.

In aggregate, this means the AggLayer avoids possible censorship and MEV extraction, while at the same time not imposing conditions on chains that connect. Aggregated L2s experience fast interoperability and complete sovereignty, with amortized cost—every benefit, and more, of the case for L3s.

Myth: Onboarding to an L3 is easier than L2s and avoids expensive bridging

Reality: L2s are as easy to onboard to or easier than L3s. L3s have a dependency—they rely on an L2 chain to connect to as many onramps as possible. Aggregated chains have no comparable chokepoint.

The argument for this myth seems to be that because L2s pushing the L3 narrative have centralized exchange (CEX) connections, a newly spun up L3 blockchain can easily onboard more users by going CEX → L2 → L3. New blockchains that haven’t yet found a CEX connection can just leverage existing ones for the L2.

In reality, aggregated L2s invert the requirements and have more inclusive onboarding: Instead of relying on a single L2 to connect with as many CEX’s as possible, which is the L3 case, in an aggregated network, what matters is the aggregate number of onramps across all chains.

Suppose a new chain, let’s call it Superdank, connects to the AggLayer. Superdank doesn’t need a CEX connection because it can leverage the CEX connections of any number of chains, like X Layer or (anticipated in the future) Polygon PoS or many more. So users of Superdank would go CEX → any connected chain → Superdank.

Superdank automatically enjoys not just unified liquidity, but also an entire aggregated user base across the network.

Instead of having to rely on the maximum number of exchanges connected to a single L2 chain, users that want to onboard to Superdank can interact from any connected L2.

And while proponents point to small, negligible fees for bridging from L2 to L3, the same is true of cross-chain transactions in the AggLayer— fees are inexpensive with low-latency.

No chokepoints, lots of choice.

L3 downsides

Time to sum up the above explicitly: L3s have more downsides than aggregated L2s. Let’s look at what these are:

- Building an L3 in a fragmented moat won’t scale any project. L3s may create interop within a single L2 ecosystem, but they face the same scaling dilemma that has traditionally plagued crypto: Fragmented liquidity and users. Aggregated chains and L2s, on the other hand, share state and liquidity. Building behind a walled garden, no matter how currently popular, won’t ever reach the interoperability heights required for a true internet-sized crypto landscape.

- Some L3s have to pay the L2, while aggregated L2s don’t. This isn’t universal, but it’s important to note: Fee extraction or rent by an L2 on an L3 is part of many L3/L2 models. It’s not equivalent for L2s in an aggregated context, which doesn’t require payment or extract rent.

- L3s rely on L2s for security—not L1s. There is a chokepoint at the heart of the L3 design: Relying on an L2 for security guarantees. The truth is that right now, L2s do not have the economic or decentralized security to serve as a settlement layer. Although more layers may decrease fees, it also includes more chances for things to go wrong—enormous block reorgs are still complex at an L3 level.

- Built-in lack of sovereignty and governance control. L3s rely on the governance and execution environments provided by the L2s. Any kind of sovereignty or governance for the L3 in itself will always be subject to the L2.

So why is L3 a thing?

It comes down to demand for blockspace and lack of ZK technology. L2s building outside of the ZK space need a means of interoperating that takes shortcuts. It makes business sense to increase demand for blockspace and lock in the network effects of L3s.

But doing this is a zero sum game, and may be detrimental to Ethereum while certainly limiting L3s. L2/L3 relationships benefit only the local L2, rather than increasing the net capacity and liquidity across crypto.

A core problem might be that L2s interested in L3s are not building with the ZK tech that can truly create secure interoperability in an aggregated network. So to make up for it, a new architecture was designed that would justify network effects and demand.

This not only recreates the current conditions of crypto, but could hypothetically serve as a challenge to Ethereum: When an L2 believes it can create sufficient network effects to spin up their own validator set with sufficient economic security.

As such, all the above are reasons to be vigilant about biased design choices and think through the win-win design of neutral aggregated networks like the AggLayer.

Tune into the blog and our social channels to keep up with updates about Polygon.

The future of Web3 is aggregated.

Website | Twitter | Forum | Telegram | Discord | Instagram | LinkedIn | Polygon Knowledge Layer

.png)

.png)

%20(1).webp)

.webp)

.webp)